By Miriam Raftery

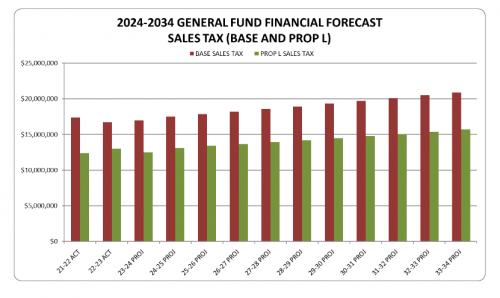

Chart, left, prepared by city staff, shows general fund forecast for next 10 years if Prop L is extended.

April 23, 2024 (La Mesa)—The La Mesa City Council will hold a special meeting at 4 p.m. today to review and discuss the Proposition L renewal survey results. Prop L, the ¾ cent sales tax increase approved by voters in 2008, is set to sunset in 2029, unless a measure to extend it is put before voters and approved. Prop L revenues currently account for 20% of the city’s general fund revenues.

The announcement of a special meeting comes after a letter sent April 17 by former Mayor Art Madrid to the current Mayor, City Council, and City Manager urging action.

Madrid says Prop L “guaranteed continued funding for existing critical services including: public safety, infrastructure maintenance, senior services, recreational programs, and that other essential programs stay during the ensuing twenty years. The $10,000,000 annual revenue generated by Proposition L is a vital and necessary revenue source that helps fund the city’s annual department operations budget. Without this funding, which ends in four short years, the City of La Mesa will be just another public agency struggling to meet the basic service needs of its residents. “

Madrid criticized city leaders for inaction up to that point, stating, “Your silence in acknowledging this significant revenue loss and the disastrous impacts on services supported by Proposition L is offensive, dangerous, and unacceptable. Your conduct seriously jeopardizes the future welfare and safety of all La Mesa residents.”

Comments

3/4 cent was for what?

Here were the arguments for and against Prop L at the time:

http://www.smartvoter.org/2008/11/04/ca/sd/prop/L/