LA MESA’S BUDGET A COMPLEX ISSUE

Annual Budget Workshop March 17

By Kristin Kjaero

A number of diverse elements contribute to the city’s financial health as a whole. In a lead up to the City’s Annual Budget Workshop, we are pleased to provide an overview for our readers.

A number of diverse elements contribute to the city’s financial health as a whole. In a lead up to the City’s Annual Budget Workshop, we are pleased to provide an overview for our readers.

CITY FINANCES

Structural Deficit

For the past two and a half years, La Mesa has grappled with a structural deficit, currently projected at $4 million per year.

Reserves have declined as a consequence, and “lower reserve balances are causing cash flow problems as the General Fund’s cash balance is insufficient to pay bills in advance of receipts during the year,” according to the General Fund Cash Flow Report.

The city anticipated the new city sales tax would eliminate the $4 million structural deficit, however, as costs continue to rise, sales decline and markets adjust, it is likely the structural deficit will be greater than previously projected.

Salaries and Benefits

Staff compensation accounts for approx. 80% of expenses, a major contributor to the structural deficit. As a defined benefit system, when CalPers investments tanked along with markets, the City was required to make up the difference.

La Mesa is also one of three cities in the County where employees receive Social Security, “the result of irrevocable employee elections in 1981 that locked in this benefit”, according to financial background material for the January 20 Council Study Session. The City and employees pay matching amounts into this program.

For these reasons, the city has been loudly criticized by taxpayer groups, while employee unions have sent representatives to monitor council meetings regarding the budget.

The next round of labor negotiations will take place in June 2009.

Reserves

The Council has set a 15% target for reserves, and according to Gary Ameling, Director of Administrative Services, “Our budgeted reserve is down to about 3%.”

When the city did its last bond issue, Moody’s Investor Services suggested the City raise the reserve target, Ameling said. “In reviewing the city’s finances and other items compared to other cities of our size, Moody’s showed us the average city of our size has a reserve of 40%. They didn’t downgrade us, but said that was something we should focus on, because the lack of diversification puts us at risk in an economic downturn.” The city has an A1 rating.

Raising the reserve target will be discussed at the Annual Budget Workshop March 17, at Councilman Ernie Ewin’s request.

“The current authorized level is 15%, but when the Police Department took us to impasses and we made the adjustment last year, we knew it would take us below that. They asked for 20%, but we enforced 6%. At this point we don’t know what our revenue will be next year, but our Prop L [Sales] Tax document says that reserves will be maintained at a level which the industry expects,” Ewin elucidated.

STEPS UNDERTAKEN

Sales Taxes

In an attempt to be proactive, voters approved a Prop L¾% La Mesa sales tax last November, which cannot be touched by state takeaways. The tax will take effect April 1, and the first proceeds will be received after July 1.

In an attempt to be proactive, voters approved a Prop L¾% La Mesa sales tax last November, which cannot be touched by state takeaways. The tax will take effect April 1, and the first proceeds will be received after July 1.

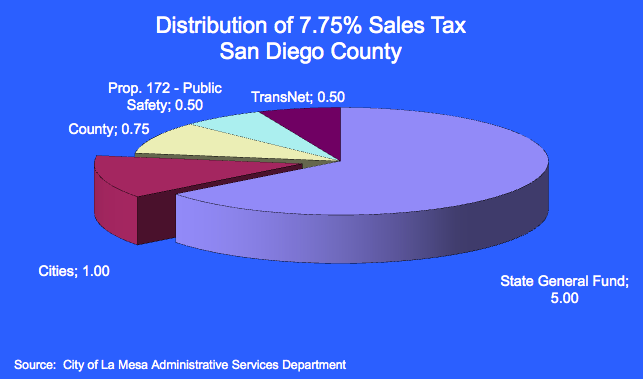

Under the statewide base sales tax, one cent of every of sales tax dollar currently comes back to local jurisdictions.

Gary Ameling put this into the perspective of reserves, “Our sales tax [revenue] is down about 6% while [more diverse] San Diego is down 2-3%, so you can see that diversification pays off during a downturn.”

Sales tax revenue in La Mesa were down 6.9% for third quarter 2008 from the preceding year, compared to 3.85% for the County and 5.1% for Southern California. Declining sales of motor vehicles (-30.1%), home furnishings (-23.2%) and electronics/appliances (-5.5%) were primarily responsible. Here is the most recent breakdown of City of La Mesa Sales taxes.

Sales tax revenue in La Mesa were down 6.9% for third quarter 2008 from the preceding year, compared to 3.85% for the County and 5.1% for Southern California. Declining sales of motor vehicles (-30.1%), home furnishings (-23.2%) and electronics/appliances (-5.5%) were primarily responsible. Here is the most recent breakdown of City of La Mesa Sales taxes.

Ameling will present updated figures at the Annual Budget Workshop. “The truth is the base sales tax is estimated to be a half a million dollars under budget. Property taxes are not expected to go down, but the 10% growth of the last few years will slow to something like 2% and experience a little lag. Because a lot of our properties are pre Prop 13 we’re not experiencing a lot of the difficulties other cities are, with our slow attrition and rollover.”

Development

|

| Provada on Fletcher Parkway is a model "success story" of Public/Private Partnerships in the City's Economic Development Strategy pamphlet. |

Infill presents the main opportunity for development in an essentially built out city. Although the recession has slowed development, it is still regarded as an important source of revenue to have projects shovel ready for when conditions improve.

The Provada project at the Grossmont Trolley Station is a model “success story” for “Public/Private Partnerships” in the City’s Economic Development Strategy pamphlet. Smart Growth incentive grants from SANDAG and low-income housing funds were used in the funding.

The Police Department site currently has no specific project, however the City Council had approved a proposal featuring high-density housing until the developer pulled it. Consequently the City sold the site to its Redevelopment Agency November 2008, in order to shift $ 8.35 million from the Redevelopment Fund to the General Fund over the next 10 years. The site is zoned “Civic Center” and “Public Use” in both General and Downtown Specific Plans, and low income housing funds were used for the purchase.

The Grossmont Center ground lease will expire in the near future, and the City has entered into preliminary discussion with the owners about potential future development projects on the site.

The City also recently sold excess parcels received from Caltrans at the intersection of Baltimore Dr. and University Ave. for $ 4 million, on which development is anticipated.

Councilman Dave Allan discussed the number of projects now in the pipeline. “When the economy gets better, the people on El Cajon Blvd have plans ready to go. Grossmont Center is talking with the city about development when their lease is up. We have the hospital, and also the Healthcare district property behind Briercrest Park we are waiting to see plans for”¦. When the post office moves, we own that piece of property. University Ave is ready to go, and the racquetball court on Palm Avenue”¦I see good things happening to this city.”

Marketing the City

|

| The Serramar Housing Development is the model for "living in the jewel of the hills" in the City's marketing pamphlet. |

In a effort to increase sales tax revenue, the City Council unanimously voted to hire the Buxton Company to study local spending practices and demographics, and, like a dating service, match the city with its corporate customers looking for locations in which to expand. Buxton had previously helped Santee bring businesses to their city.

Initially the city paid $70,000 for the research, report and list of matching companies, meetings and scouting service for one year, which expired in January.

According to Ameling, “Buxton was paid with money from the Fletcher Parkway Redevelopment project area and the Downtown Parking Fund. These areas matched up with the areas they studied. No General Fund monies were used.”

La Mesa produced a pamphlet to market itself to prospective companies, which can be viewed here.

No companies have located in La Mesa as a direct result of this effort, however, Assistant City Manager Dave Witt explained, “All the prior products are still valid. We’re built out so our demographics won’t shift so fast, they will be good for another 2-3 years.”

Although she declined an interview, at City Council meetings Councilman Ruth Sterling has criticized money spent on Buxton and related travel to the International Conference of Shopping Centers.

Councilman Mark Arapostathis takes the long view, “The City has sent numerous letters and information to National Credit tenants that our profile would be attractive to and sought their interest in the community as a future new location. This is a long-term strategy and not one that will produce results in a short period of time.”

Intermediate Library-Post Office Land Swap

|

| Is this the "intermediate" or permanent library site? A landswap bill is yet to be paid. |

Is the new library location intermediate or is it permanent? A large bill will come due in 2016, which, according to Witt, is “too far out there to set aside funds for the future liability. It’s an existing liability that’s out there.”

The building that currently houses the library was constructed as a temporary location. The hope was that a larger, permanent library be funded from a state grants, so that the “intermediate” location could later be converted into an extension for an over crowded City Hall.

La Mesa and the County entered into a land swap agreement that says that within ten years, the City must either build a larger Library on the old Post Office site, or pay fair market value for the land that the City acquired from the County that housed the old library.

However, as the state budget crisis deepened library grants were discontinued, meanwhile land values, construction costs and City finances have radically changed.

Future plans are now seen as uncertain by some of the Council. “The circumstances when we were planning for a permanent library have disappeared”¦As far as I’m concerned it’s a permanent library. It’s my opinion,” said Mayor Art Madrid.

It’s also possible the City might consider developing the old post office site in other ways based on economics. Councilman Ewin stated, “If we look at the library it might be the right size; then we might develop the other parcel and get a good price that we can put back into it”¦As far as I’m concerned it is a temporary location until we get resolution as to when and how we can erect a permanent library. And at present that would be only if we got state funding.”

FURTHER AHEAD

Fire Consolidation

Recently Fire Chiefs and City Managers from La Mesa, Lemon Grove, El Cajon and Santee have met to explore ways they might save money by avoiding duplication. Although San Miguel Fire District is the geographical center, it is not participating in the talks at this time.

|

| City Councilman and retired Firefighter Dave Allan |

City Councilman and retired Firefighter Dave Allan described one model for the type of arrangement that might be considered, “I see it as a joint powers authority. We already have one in place for thirty-five years for training and communications.”

It’s about directing limited funds where they will be most effective, Allan explained, “I think everything’s on the table. Do you turn around and have fire stations that are a mile from each other [in two cities] and if one needs to be rebuilt, do you do it? You don’t lose staffing. You’re not going to lose firefighters, but if there’s overlap on overlay”¦”

Constant staffing has recently been initiated. “Constant staffing is going to save us $200,000-$300,000 a year. If you compare the overtime to staffing, it will save us in today’s time when you’re talking about pensions and benefits,” Allan said.

Cost Recovery Policy

After determining that the City had some of the lowest fees in the County, in 2004 the Council approved a 100% recovery policy for the cost of services provided.

After determining that the City had some of the lowest fees in the County, in 2004 the Council approved a 100% recovery policy for the cost of services provided.

It also decided Oktoberfest organizers would pay 25% that year increasing 25% annually to full recovery, however, the next two years the Council approved 40% recovery. Ameling summed up the consensus, ““¦intangibles are significant. It’s the signature community event historically.”

This year the Council set the Oktoberfest rate at 50%, leaving $34,193.25 underwritten by the City. Staff stated it would cost more in staff time to calculate sales taxes generated by the Oktoberfest than it receives, but gave a rough estimate of around $4,000 for the Oktoberfest.

The Car Show series, also organized by the Village Merchants Association was charged a 50% recovery rate, leaving $9,773.57 underwritten by the City.

The question has been raised at Council meetings whether, as Oktoberfest has evolved from a local community festival to something that doubles the city’s population during the event, it is appropriate to underwrite a commercial event organized by businesses in the Village. Councilman Allan addressed this concern, “That’s a good question. It’s been tradition, but I think in today’s times everything needs to be looked at.”

A discussion of outdoor assemblage permits is slated for an upcoming Council agenda. Councilman Ewin stated, “I think in the future we may look for a little more recovery. In the current economy this Council is more aware that we need to know what we’re forgiving and what we’re enabling.”

Travel Policies

Travel expense will be discussed at the Annual Budget Workshop.

Staff has a no travel policy this year, unless it is mandatory and paid for by outside funds or the employee. The budget allocates $5,000 travel expenses to each Councilmember and $7,500 for the Mayor.

Councilman Sterling has been a lone voice advocating cutting all Council travel.

|

| Mayor Art Madrid |

Mayor Madrid countered, “You need to go out there and find out what the best practices are, so you can craft policies. Local governments are where the rubber hits the road. One of the reasons we are pushing the stimulus package on the local level is that nationally metro areas account for 86% of national employment, 90% of labor income, and 90% of GDP, so when the economy gets hit cities are impacted the most.”

Councilman Allan referred to MediCal/Medicare workshop and Police Department grants received because, as one of five representatives from California to the National League of Public Safety, he heard early on about opportunities to apply for grant. “If we look at the stimulus package, I guarantee I get money a lot faster than other people, because it’s all about being at the table”¦I look at travel as something to market my city.”

ON LINE RESOURCES

The City Manager’s Financial Background Material for the Council Study Session 1-20-09 includes a detailed discussion of budgeting, financial policies, salaries and benefits, major projects, and the recent city sales tax addition.

Quarterly Budget Monitoring and Monthly Cash Flow Reports

Quarterly City Treasurer’s Report on investments

The Annual Report from the Independent Citizen’s Bond Oversight Committee Report and the Quarterly Status Report on the Construction of the New Public Facilities are available on the January 13, 2009 City Council Agenda.

Recent comments